Doorda

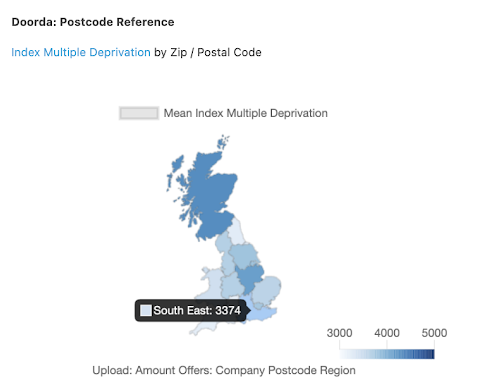

One of the datasets in Funding Circle's data universe is the vast collection of public data from government organisations, such as local and national governments, regulatory agencies and other public bodies. This data is provided through a company called Doorda, which collects, cleans, structures, documents and models this ever expanding and evolving universe of public data. “We know the value of this data, and already use it in our machine learning models. The question is; do we use all relevant insights, and are we not missing anything important that could help us make faster and better decisions?” asks Rohan.

Doorda Data at Funding Circle

Funding Circle carefully tracks its performance through a number of key indicators, such as campaign response rates, application success rate, credit scoring, payment performance and more. Rohan's team looks at past outcomes and asks; “Could we have done better if we had used more data? For example, could we improve marketing response rates or better assess credit risk by focusing on aspects of a business that we could derive from the Doorda datasets?” While the Doorda data is well- structured and documented, due to its size and variety, exploring this dataset manually to find such insights would take weeks to months of analysts' time. Moreover, a manual approach would only cover questions that the team could come up with.

What Rohan and team needed is a platform that:

- Ingests data from different sources

- Automatically processes, formats, cleans and combines that data

- Identifies all relevant relationships in the data, and provides visual exploration

- Allows users to quickly test their own hypotheses and models

- Allow users to store, share and discuss the results